The Bank Officer(s) of the Borrower have to be fully aware and knowledgeable of the ongoing borrowing and lending transaction. This means that at any specific time, when a Bank-to-Bank communication will be established, between the Borrower’s Bank and the Provider's Bank, for the Instrument transfer, the Bank Officers of the Borrower Closing Bank will have to be in a position to fully approve the receipt of the Instrument in favour of the Borrower and be in the position to confirm payment for the instrument and provide the guarantee to give back the original bank instrument to the issuing bank 15 days before the contract maturity date, unencumbered and free of liens, by SWIFT.

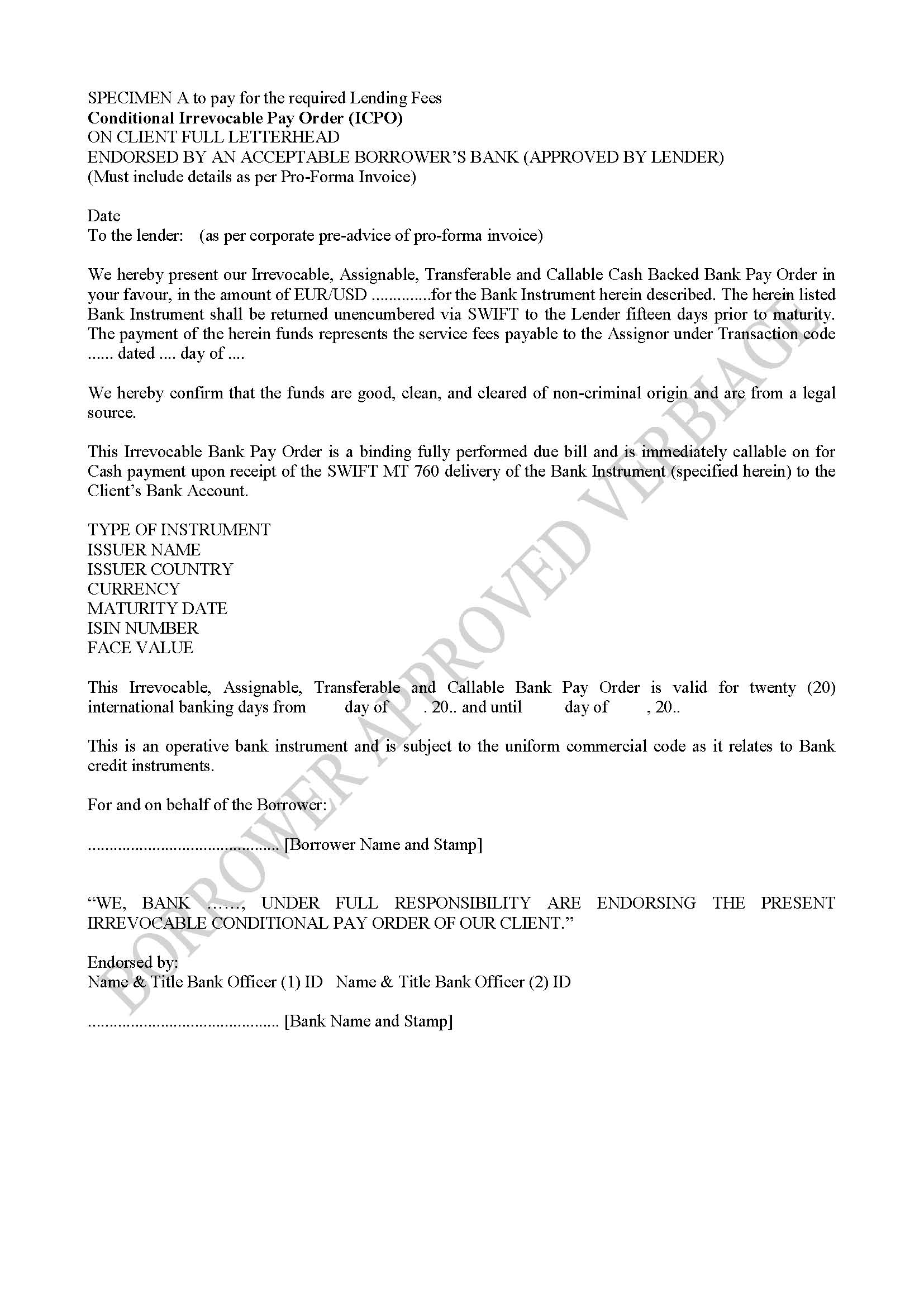

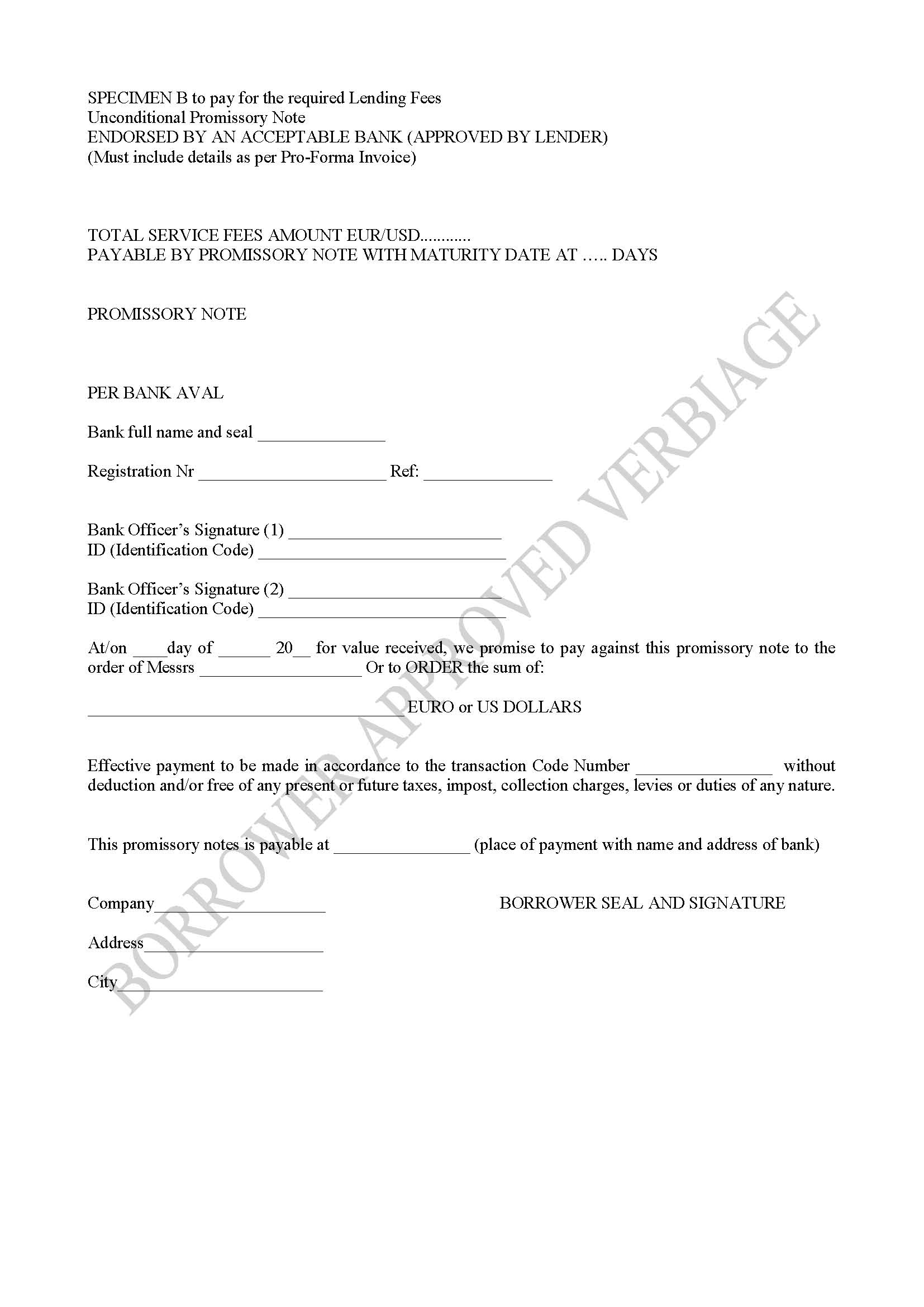

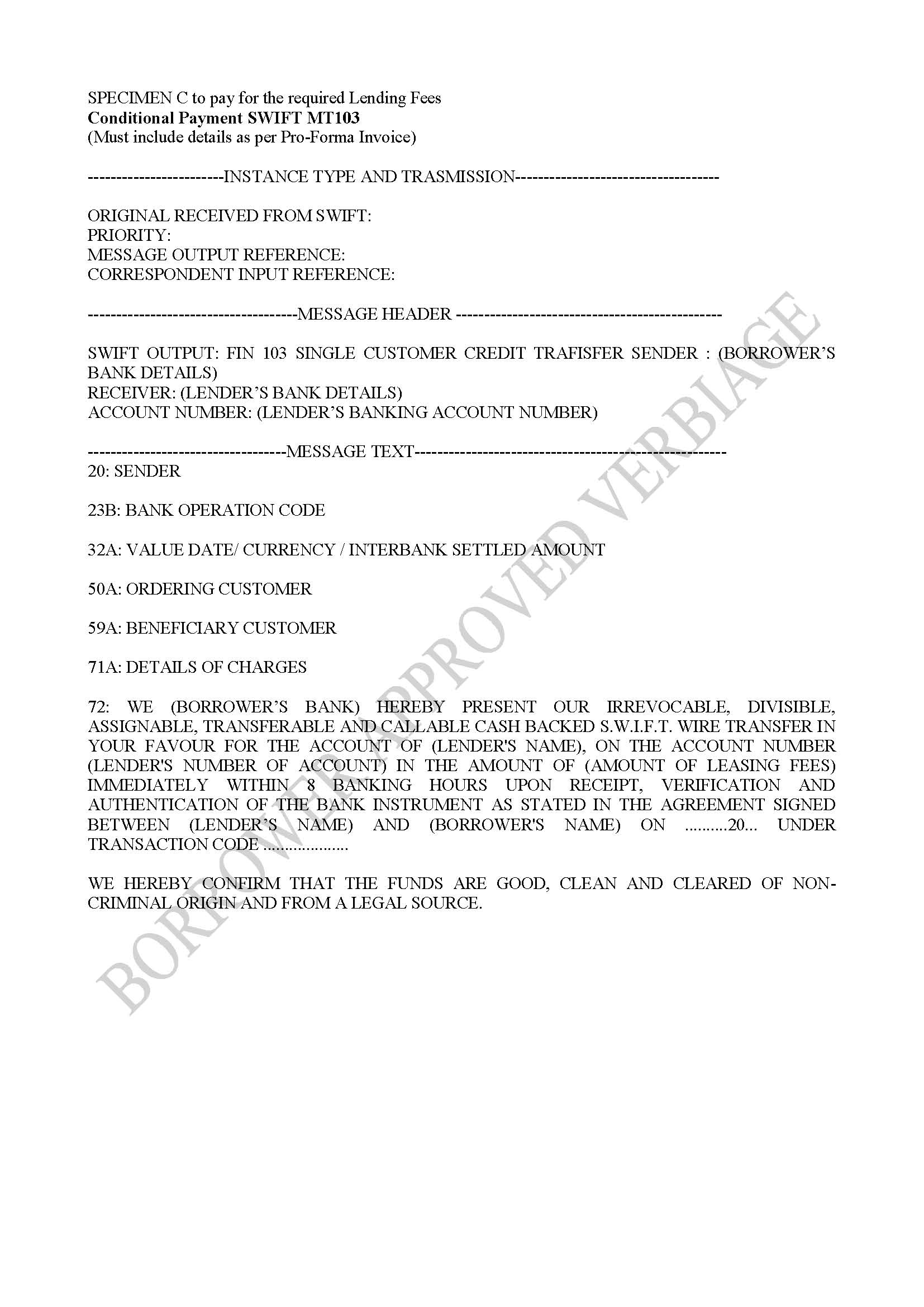

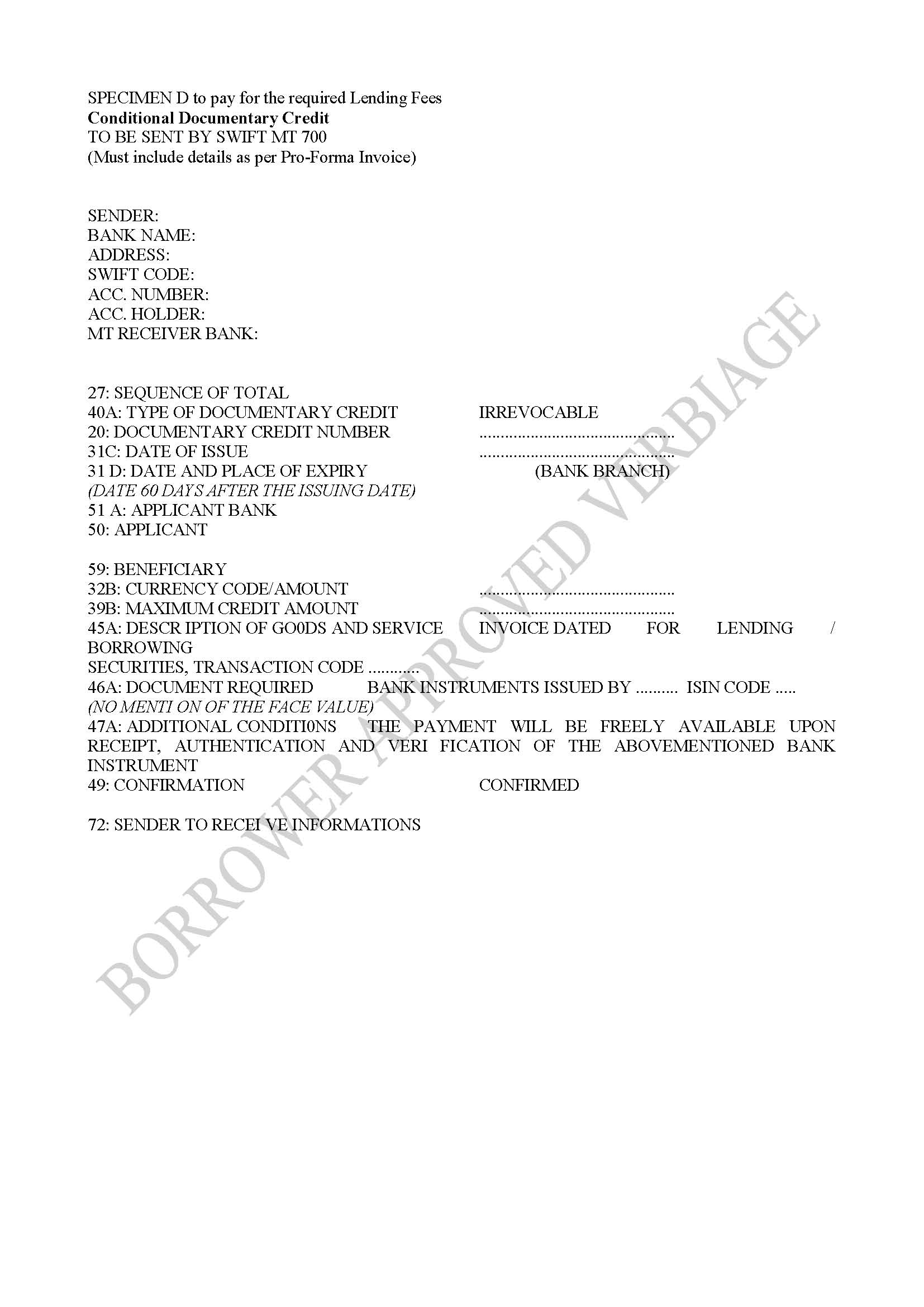

Since this is probably the only way in which you can expect a third party to provide you with a valid, fully cash backed SBLC/BG, which comes with an absolutely clean verbiage and is divisible and assignable, this transaction has to be fully transparent among banks involved. Both banks have to communicate and the collateral (SBLC/BG) will only be emitted and transferred to the receiving bank once the receiving bank agrees to the return of the collateral after 350 and provides its consent accordingly. The receiving bank also will have to provide or endorse any of the 4 conditional payment instruments: (A) Conditional Irrevocable Pay Order (ICPO) endorsed by borrower’s bank, (B) Unconditional Promissory Note endorsed by receiving bank, (C) conditional payment SWIFT MT103, (D) Conditional Documentary Credit to be sent by SWIFT MT 700- All payment options have to be acceptable and approved by the collateral lender.