We deliver a highly rated Financial Instrument to you now, and you only pay for it later!

With the help of our financial instruments you can structure Securities much faster, show Proof of Capability to Enter Larger Investment Opportunities and you can enhance your Credit. Borrowing financial collateral through us can open up numerous lucrative options now, and it provides for you the option to pay for our service only after 180 days!

You can obtain financing for any kind of a commercial viable project if it is backed by our financial Prime Bank collateral. It does not really matter if it is an existing business wishing to expand, or a brand new Start-Up Project. You can access and benefit from financial support provided through our Prime Bank collateral if your finances are sound, your business is of substance and you are supported by your own bank, finally confirmed to be acceptable for this transaction by the facilitator. If you are qualified accordingly, you can borrow Financial Instruments like BONDS, MTN, BG or SBLC to back up your transaction with financial collateral of a top Prime Bank if you seek to carry out a Petroleum / Commodities Transaction, obtain Loans and Funding for Business or Projects, seek Monetization, or seek to participate in HYI/PPP programs. If you hit any of the above links you can discover your solution and find out how you can benefit from our business support now and pay later!

The actual process to back up this Prime Bank guarantee service, issue and send a BOND, MTN, Bank Guarantee or Standby Letter of Credit to your receiving bank, this would be the process:

After contract and Once the Reservation Fees has been committed and the endorsing bank’s confirmation to endorse the Promissory note is available, the Securities Borrowing and Lending Agreement is requested and securities can be identified by ISIN, the Call Option fee reserves these securities for 20 days. At this stage, the client will then have all details of these securities and can request Bloomberg Printout, Security Card of the Stock Exchange market where the instrument is quoted, Prospectus of the Issuing Program of the Bank to permit the designated Borrower’s Bank Officer to check the availability on Euroclear, Clearstream or the Bloomberg systems.

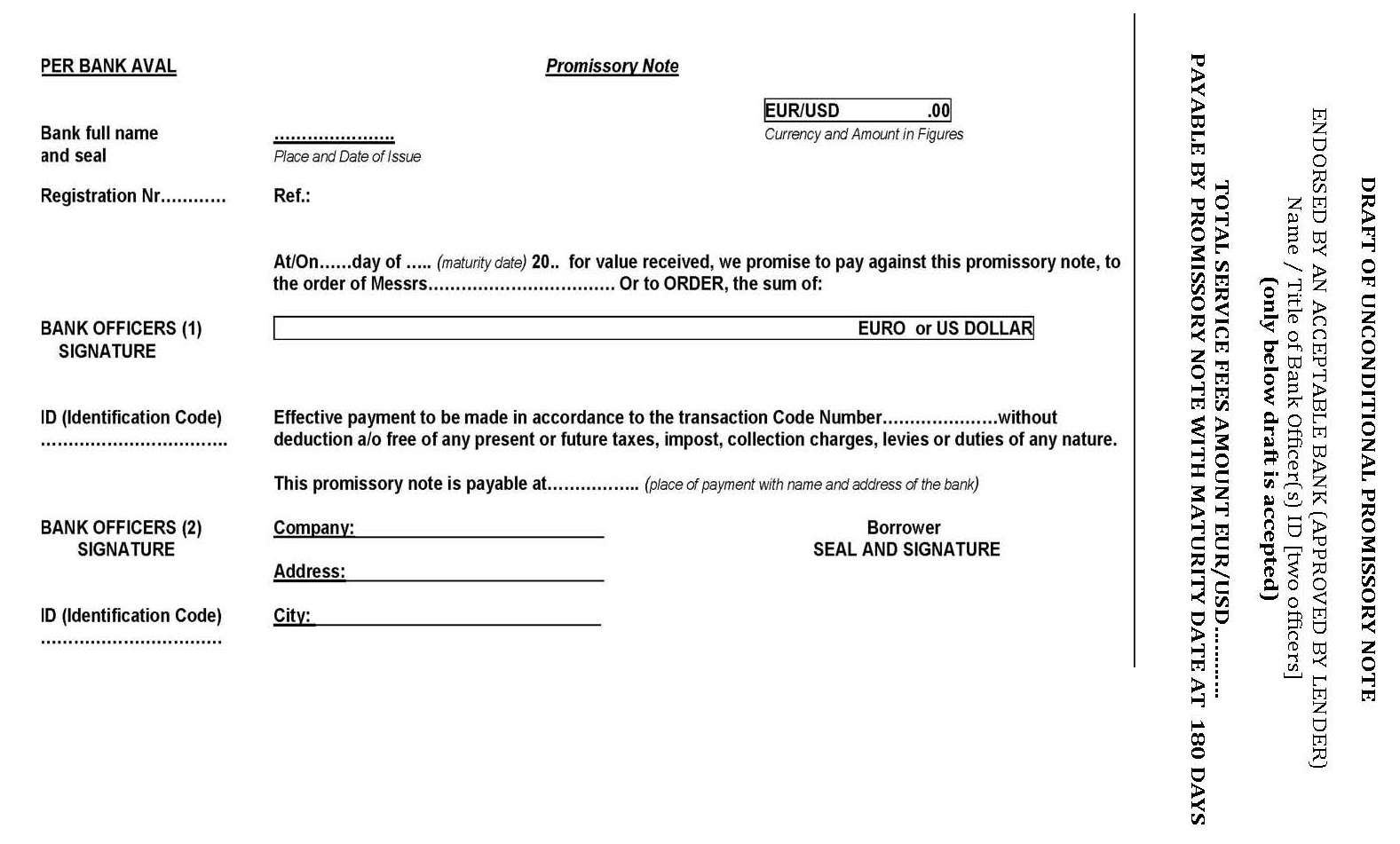

A Promissory Note is the preferred payment method for the lending fees since it offers 180 day deferred payment for the Borrowing and Lending Fees. One the securities are identified they are not yet owned or purchased by the investor backing up the deal. These securities will only be purchased once all issues of the promissory note have been sorted out and the borrower has been received instructions for the delivery of the Promissory Note by the securities dealer.

A promissory note is a financial instrument that contains a written promise by one party (the Borrower) to pay another party (the Lender) a definite sum of money at a specified future date. If a client has a credit line with a bank, an endorsement of a promissory note can successfully be obtained. The promissory note is a preferred option by borrowers because it allows paying the leasing fees after 180 days. It is however also for this reason that payment cannot be conditioned because the leased instrument had been already delivered to borrower’s receiving bank.

You will have to complete the Promissory Note and follow these steps:

- The signature and the seal of the borrower has to be entered near their address, in the space where it is written “SEAL &SIGNATURE”

On the left column you will have to arrange for

- Bank stamp and address

- Bank officers Names (typed) near their signatures and their ID (identification code)

- Number and date of registration corresponding to this PN in the bank books (all banks have this book where they must enter the bank engagements) because endorsement of a PN must be on bank asset.

After that you will have to provide the Intake Officer with a scanned copy of your Promissory Note by e-mail for due diligence and to obtain approval. Once there is a positive response from endorsing banks to due diligence queries, the borrower will be provided with the instructions for delivery of the Promissory Note.

On receipt of the original Promissory Note covering the borrowing and lending fees to be paid after 180 days for the use of the financial collateral, the securities backing up your BG / SBLC instrument will be purchased and the borrowed fully cash backed, assignable and divisible Standby Letter of Credit, or the Bank Guarantee of a top rated Prime Bank is send by SWIFT MT760 to your receiving bank.

We prefer to work with qualified clients with good banking relation to leverage a client’s financial possibilities. Chances to materialize a transaction can be very high if your company is already of substance and you want to extend your immediate investment capacity. If you would like to discuss any of these options, please use the reply form, or call 00353860325153. This number also works on Whatsapp, Signal, Telegram and WeChat.

Funding African Trading Transactions

The Power of a Loan Agreement

A helpful Strategy to attract Investors

How a Loan Agreement can attract investors.

Proof to be eligible to borrow funds

How to benefit from a Loan Agreement if you don’t have collateral.

How to benefit from a Loan Agreement asking for collateral.

How a Loan Agreement can get you in funds.

Why should a client provide a Mandate and place a retainer to get a bank instrument and credit enhancement service?

Not satisfied with the results of your own Project Funding activities?